● 기업단신

CarMax — Shares of the used car seller slid 4.8% after JPMorgan downgraded them to underweight, saying investors aren’t fully pricing in the risks surrounding the company and hope for a recovery looks “premature.” CarMax fell 53% in 2022 but has risen 18% since its disappointing quarterly results in December.

Salesforce — The software giant fell about 3% after Bernstein downgraded the shares to underperform from market perform, saying they’re falling into a “growth purgatory” and could have difficulty climbing out of it. That comes a week after the company announced its plan to reduce staff. Shares could fall another 20%, according to Bernstein.

Coinbase — Shares of the crypto services provider fell about 3% following a downgrade from Bank of America, which said consensus estimates on Coinbase are “way too high” given the current crypto outlook. That came a day after the company announced a second round of layoffs comprising about 950 jobs, of a fifth of the company. Coinbase shares dropped 86% in 2022 as macro conditions and scandal dragged down the crypto market.

Tesla — Tesla shares rose 2% after the EV maker registered with the state of Texas to expand its electric vehicle factory in Austin this year. Separately, Goldman Sachs also named the stock a top pick for 2023.

Levi Strauss & Co — Shares of the clothing company slipped 2.2% after Citi downgraded the stock to neutral from buy. The firm cited weaker denim trends that could pressure the company in the near to medium term.

Warner Bros Discovery — Guggenheim upgraded the media company to buy from neutral Wednesday, citing an attractive risk/reward and narrative for the first half of the year. Warner Bros. Discovery rose 1.75% in the premarket, following an 8% gain Tuesday.

Toll Brothers — Shares of the homebuilder rose nearly 2% after Bank of America upgraded Toll Brothers to buy from neutral, noting: “TOL will face incremental headwinds from incentives and mix shift through the year, but this will be offset by tailwinds lower input costs, especially lumber.”

Wells Fargo — Wells Fargo is shrinking its footprint in the mortgage market as the bank manages regulatory pressure and the impact of higher rates on housing. The company was once the biggest mortgage lender in the country. It will now limit home loans to existing customers and borrowers from minority communities. Shares were higher by less than 1% premarket.

Southwest Airlines — Susquehanna downgraded the airline to neutral from positive, citing the operational meltdown during the recent winter storm. Southwest lost 1.55% in the premarket.

Walt Disney — Disney revised its pricing policies at its domestic theme parks, making a number of modifications to its reservation and ticketing system, as well as its annual pass membership perks, to make it easier for loyal customers to attend. Shares were higher by less than 1% premarket.

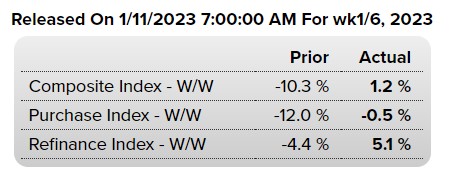

● MBA Mortgage Applications

● 장전 상황

Stocks rise as investors await inflation data, Nasdaq attempts four-day winning streak.

Stocks rose Wednesday as Wall Street looked to build on what has been a positive start to 2023 so far.

Futures tied to the Dow Jones Industrial Average advanced 107 points, or 0.3%. S&P 500 futures added 0.4%, while Nasdaq 100 futures gained 0.3%.

The moves come after the Nasdaq Composite rose 1.01% on Tuesday to clinch its first three-day winning streak since November. The S&P 500 and Dow rose 0.70% and 0.56%, respectively, and all three averages are positive for the young year.

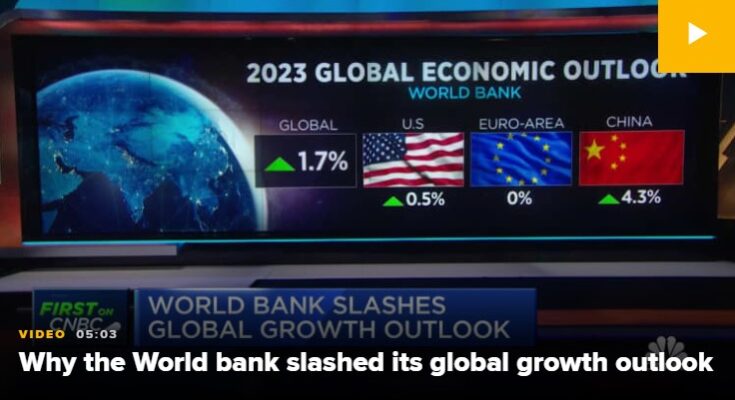

● The World Bank’s warning

The World Bank has grown more pessimistic about the global economy, dramatically cutting its projections for growth. “Global growth has slowed to the extent that the global economy is perilously close to falling into recession,” the institution said Tuesday. Overall, it said it now expects global economic growth to hit 1.7% this year, down from its previous call of 3%. The World Bank significantly cut its outlook for U.S. economic growth, as well: down to 0.5% from its earlier projection of 2.4%. If these projections come to fruition, they would represent the third-slowest pace of growth in about 30 years, trailing only the slowdowns triggered by the financial crisis and the Covid pandemic, the World Bank said.

● US House Republicans passed a bill to stop funding for Internal Revenues Service. The first bill passed in the GOP-controlled chamber would make it easier for rich people to get away with fraud.

Luckily for fiscal responsibility, this bill to cut IRS funding is unlikely to become law while the Democrats control the Senate and president Joe Biden is in the White House. But it is important context for the upcoming budget fights that will define the next year in Washington, D.C.

● A South Korean company wants to build North America’s largest solar panel plant. Hanwha Solutions announced a $2.6 billion investment in Georgia to build a new manufacturing complex and expand its existing factory in Dalton.

● Bed Bath & Beyond reported a quarterly loss of nearly $400 million. The struggling retail giant’s results missed analysts’ expectations, increasing the likelihood of a bankruptcy filing.