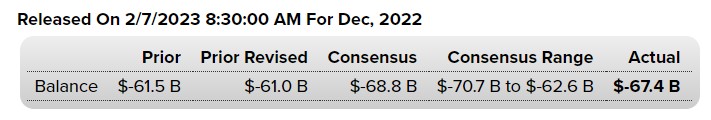

● International Trade in Goods and Services

● 기업단신

Chegg — Shares dropped 22.7% following its earnings report Monday . The company gave first-quarter and full-year revenue guidance that was below analyst expectations, according to Refinitiv. Chegg noted subscriber growth challenges and concerns related to the health of the broader economy.

Baidu — Shares surged more than 13% after Baidu said it would launch its own artificial intelligence chatbot that will be called “Ernie Bot” in English.

Bed Bath & Beyond — Shares plunged 30% after Bed Bath & Beyond announced a public offering to raise roughly $1 billion.

Oak Street Health — Oak Street Health shares surged more than 36% after The Wall Street Journal reported CVS Health is nearing a $10.5 billion deal for the primary care provider. CVS shares were little changed.

Hertz — Shares gained more than 4% after Hertz reported results that beat earnings per share and revenue expectations, according to FactSet.

ZoomInfo Technologies — Shares fell more than 11% after ZoomInfo Technologies’ latest earnings results. The software company beat on the top and bottom lines, according to FactSet. However, it posted a lackluster revenue outlook for the first quarter and full year.

Spirit Airlines — The airline stock jumped 3% in premarket after the company posted stronger-than-expected fourth-quarter earnings. Spirit Airlines reported earnings of 12 cents per share excluding items, 9 cents higher than the analysts’ estimate, according to FactSet.

Skyworks Solutions — Shares added more than 2% after Skyworks Solutions announced a $2 billion share buyback program. The announcement helped investors overlook an slight earnings miss in the semiconductor firm’s most recent quarter.

Activision Blizzard — Shares rose 2% after Activision Blizzard topped revenue expectations in its most recent quarter. The firm reported $3.57 billion in revenue, greater than consensus expectations for $3.16 billion in revenue, according to Refinitiv.

Pinterest — Pinterest shares dipped more than 1% after the image sharing company posted mixed earnings results. The firm reported earnings of 29 cents per share, greater than forecasts for 27 cents per share, according to consensus expectations from Refinitiv. However, revenue came in at $877 million, lower than the $886 million estimate.

DuPont de Nemours — Shares declined 2% after DuPont de Nemours posted earnings results from its most recent quarter. The firm beat expectations on the top and bottom lines, but its earnings and revenue guidance for the first quarter was much lower than estimates.

Leggett & Platt — Shares fell more than 1% after Leggett & Platt reported disappointing earnings results, according to consensus expectations on FactSet.

● 장전상황

S&P 500 futures were down slightly Tuesday as investors waited for the latest remarks from Federal Reserve Chairman Jerome Powell.

Futures tied to the broad index were down 0.3%, while futures connected to the Dow Jones Industrial Average lost 154 points, or 0.5%. Nasdaq-100 futures shed 0.1%.

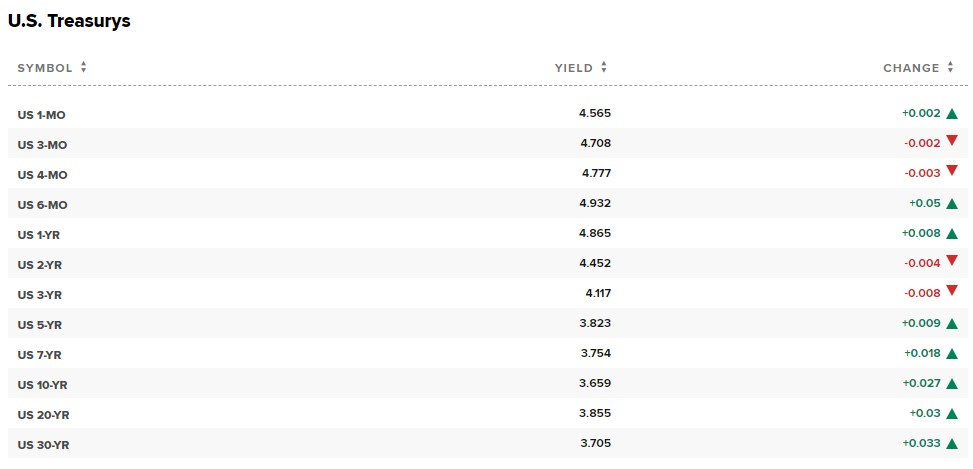

A speech from Powell before the Economic Club of Washington scheduled for Tuesday afternoon remains top of mind for investors. Markets interpreted a slew of his disinflation comments during last week’s post-meeting press conference as dovish and stocks rallied. Many view the appearance as an opportunity for Powell to offer more clarity on where rates are headed, or clarify some comments made after last week’s 25 basis point rate hike.

Minneapolis Fed President Neel Kashkari said on CNBC early Tuesday that the Fed has not cooled inflation enough to “declare victory.”

Earnings season presses on Tuesday with results from companies such as Chipotle. So far this season, a little over half of S&P 500 companies have reported earnings, with about 69% surpassing expectations, according to FactSet data.

● State of the Union time

When he delivers the State of the Union address Tuesday night, President Joe Biden will have a big stage to defend the economy under his watch. He’ll have plenty to brag about. Unemployment is historically low, wages have grown, and fears of a recession are in check, for now. But, as CNBC’s Emma Kinery points out, it’s much more complicated than that. Inflation is still high, the Fed is raising interest rates, and while a recession may not hit soon, there’s still a chance for a rough landing. There’s also the pressing matter of the debt limit. The United States breached it recently, but has enacted extraordinary measures to hold off a default for months. Biden will need to explain how the government will avoid this economic catastrophe while contending with a GOP-run House.

* The speech is expected to renew a push to cap the price of insulin for all patients, not just those covered by Medicare.

● The White House secured investment pledges worth $4.2 billion for Central American countries.

Forty-seven American companies including Target joined the initiative to direct private-sector spending to countries lacking in economic opportunities.

● Welcome to the AI wars

It’s on now. Google, under pressure to respond to artificial intelligence chatbot ChatGPT, announced its own conversational AI product, Bard. The Alphabet company will roll out Bard in the next few weeks, and it’s an all-hands-on-deck situation. In an internal memo sent soon after the Bard announcement, CEO Sundar Pichai called on every Google employee to help test the product. “We’re looking forward to getting all of your feedback — in the spirit of an internal hackathon — more details coming soon,” Pichai wrote. Meanwhile, Microsoft appears to be set to make an AI-related announcement Tuesday. The company, which has invested in ChatGPT’s creator, OpenAI. Indeed OpenAI CEO Sam Altman tweeted a picture of himself and Microsoft CEO Satya Nadella in Microsoft’s hometown of Redmond, Washington, saying he was “excited” for the event.

● Falling numbers of meat buyers hurt Tyson Foods’ profit.

Shares of the largest meat company in the US fell more than 5% after first-quarter earnings missed expectations.

● Bed Bath & Beyond raised more than $1 billion.

The struggling retailer struck an equity deal to stay afloat, according to the Wall Street Journal.

* 왠지 느낌이 밑빠진 독인데….