● 기업단신

Norfolk Southern — Shares slid more than 3% following reports that the Environmental Protection Agency sent the rail company a notice of potential liability over the weekend. The notice was related to last week’s explosion and derailment of railcars containing hazardous materials in East Palestine, Ohio.

Meta — Shares of the Facebook parent rose 2.6% after the Financial Times reported it is planning a fresh round of layoffs after it last let go of 11,000 employees in November. The company’s stock price has soared by more than 44% so far this year.

Caterpillar — Shares of the machinery company fell more than 1% after Baird downgraded Caterpillar to neutral from outperform. The investment firm said in a note to clients that Caterpillar is “nearing a cyclical pivot point” and that revenue growth is set to slow.

Ralph Lauren — Shares of the apparel retailer were up 2.5% after Bank of America upgraded the stock to buy from neutral, and also raised its price target, saying the brand is differentiating itself among its peers during challenging time. The call follows an upbeat earnings report on Thursday.

Fidelity National Information Services — The company shed 8.5% in the premarket. Although it reported a slight earnings and revenue beat, its forecast fell short of expectations. Fidelity anticipates first-quarter adjusted EPS of $1.17-$1.23 versus a StreetAccount estimate of $1.42, and revenue of $3.38 billion to $3.43 billion compared with an expected $3.57 billion.

Cadence Design Systems — Shares were up 1.7% in premarket trading ahead of the company’s scheduled fourth-quarter earnings release on Monday. Cadence expects to report revenue in the range of $870 million to $890 million. Analysts surveyed by Refinitiv expect the company to earn 92 cents a share on revenue of $884.8 million.

● 이번 주 실적발표

● Factset

● 장전 상황

Stocks rose Monday as traders regained their footing after the S&P 500 and Nasdaq Composite suffered their worst weekly declines in nearly two months.

The S&P 500 climbed 0.17%. The Dow Jones Industrial Average rose 41 points, or 0.12%, while the Nasdaq composite climbed 0.29%.

All three major indexes ended the week on a downturn. The Dow slipped 0.17%, the S&P 500 fell 1.11%, and the tech-heavy Nasdaq slid 2.41%, marking their biggest weekly losses since December.

● Watch the skies

What’s with all the close encounters in North American air space lately? Things from another world? Almost certainly not, although a top U.S. military officer, when asked whether aliens were involved, said he hasn’t ruled out anything. “I’ll let the intel community and the counterintelligence community figure that out,” said Gen. Glen VanHerck, commander the North American Aerospace Defense Command and U.S. Northern Command. The wild speculation came as U.S. jets shot more objects out of North American skies over the weekend, days after they took down a Chinese spy balloon that floated over much of the United States. The more recent objects haven’t been as big as the Chinese balloon, and it’s not clear where they might have come from. And lawmakers are demanding answers. The truth is out there, probably.

● Explaining the housing market

It can be hard to keep up with all the ups, downs and sideways moves in the housing market. What’s going on with home prices these days, anyway? CNBC’s Diana Olick breaks it down. While price increases have been slowing for months, actual prices are still higher than they were 12 months prior. With mortgage rates easing off a bit, demand appears to be returning, and that could help nudge prices up a bit again. “While prices continued to fall from November, the rate of decline was lower than that seen in the summer and still adds up to only a 3% cumulative drop in prices since last spring’s peak,” said CoreLogic’s chief economist, Selma Hepp.

● A record airplane deal is in the works for Airbus and Boeing.

Air India has reportedly inked agreements with the two planemakers for more than 500 orders, which would be the largest in aviation history.

● APPLE’S GOT THE BEST SEATS TO THE AI SHOWDOWN

Tech companies are champing at the bit to build the next generation of AI-powered search engines. It could be a ripe opportunity for Apple to make some big bucks.

For years, Google has been paying to ensure that its search engine is built by default into Apple devices. The cost is formidable. Analysts estimate that Google paid as much as $10 billion in 2020 and $15 billion in 2021, securing a prime spot to rake in search advertising revenue.

But now Microsoft has entered the wings with its own AI-augmented Bing. Should Bing overtake Bard, Apple could sit back and enjoy an ensuing bidding war between Google and Microsoft. That is, if Apple hasn’t developed its own search engine first.

Apple has no search engine of its own (as yet, at any rate) and no generative AI chatbot waiting in the wings. But it can still stand by the side of the track and make plenty of money off the hectic AI sprints of its competitors.

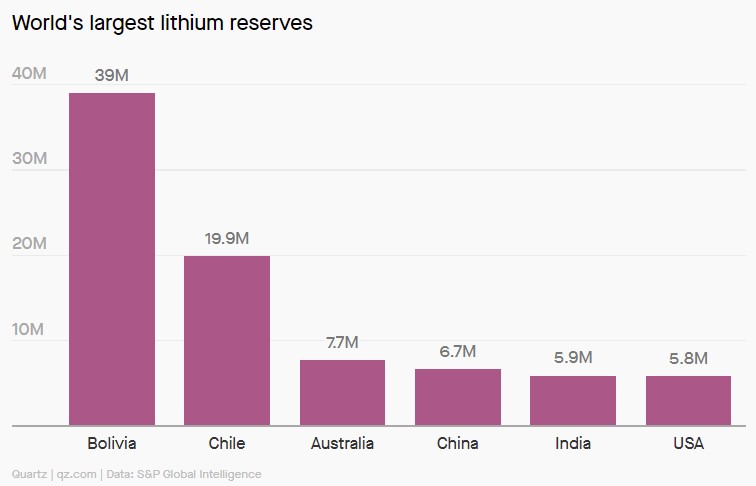

● HOW MUCH LITHIUM DOES INDIA HAVE?

Last week, India suddenly became the country with the fifth-largest reserve of lithium in the world, after 5.9 million tons of the resource was discovered.

The finding of such a large swath of lithium, which is used to make batteries and EVs, could not have come at a better time. It gives fuel to Narendra Modi’s Hindu nationalist fire and the country’s quest to become a global manufacturing leader. But there’s a catch: India will now need to create an infrastructure to refine the metal into a usable mineral, which is going to take years, and carries with it a huge environmental cost.