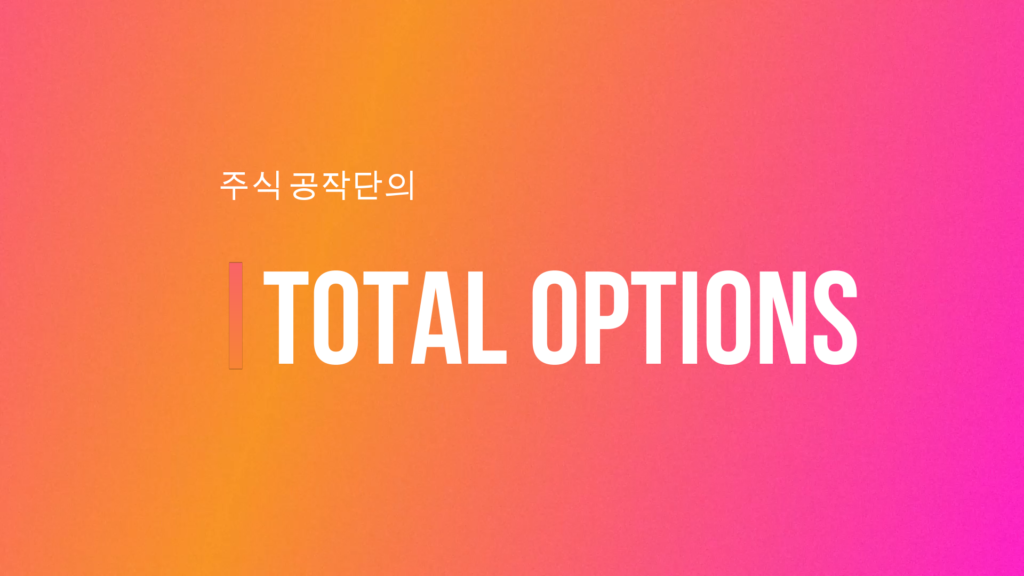

● Jobless Claims

● 기업단신

Tapestry — The company reported adjusted fiscal second-quarter earnings before the bell of $1.33, beating StreetAccount’s estimate of $1.27, and raised its fiscal 2023 earnings outlook. Tapestry rallied nearly 10% in the premarket.

Hilton Worldwide — The hotel operator reported adjusted fourth-quarter earnings of $1.59 per share before the bell, topping estimates of $1.22, per StreetAccount. Its revenue of $2.44 billion also came above the $2.35 billion expected. Hilton was up 1.2% in the premarket.

Credit Suisse — The Swiss bank reported a fourth-quarter and annual loss that missed estimates and said it is expecting another “substantial” full-year loss in 2023. Credit Suisse slumped nearly 8% in premarket trading.

PepsiCo — The beverage giant reported adjusted fourth-quarter earnings and revenue before the bell that beat expectations, thanks to price hikes that boosted sales. It also announced a 10% increase in its annualized dividend. Pepsi gained nearly 2% in the premarket.

Tesla — The electric-vehicle maker gained more than 3% in the premarket. On Wednesday, Tesla was cleared from blame in the crash of one of its vehicles in Texas. Earlier this week, CEO Elon Musk said he would unveil his “Master Plan 3” at investor day.

Disney — The entertainment company’s shares jumped more than 6% following the company’s better-than-expected earnings report. Disney reported a smaller-than-expected drop in subscribers, as well as a beat on the top and bottom lines. CEO Bob Iger, who returned to the company in November, also announced that Disney would be slashing 7,000 jobs as part of a broader cost-cutting and restructuring plan.

Affirm — The buy now, pay later finance company dropped 17.6% in premarket trading after reporting an earnings and revenue miss Wednesday. Affirm also announced layoffs of 19% of the workforce and was subsequently downgraded by RBC Capital Markets to sector perform from outperform.

Mattel — The toymaker lost 11% after fourth-quarter results that missed analyst estimates due to sagging holiday sales. Mattel’s adjusted earnings per share was 18 cents, compared to the 29 cents expected, per Refinitiv, while revenue was $1.4 billion versus the $1.68 billion expected.

Robinhood — Shares of the brokerage platform rose more than 4% in premarket trading despite Robinhood’s fourth quarter revenues coming short of expectations. The company reported $380 million in revenue, below the $397 million expected from analysts, according to Refinitiv. Robinhood also reported a net loss of $166 million for the quarter, though it saw improvements in metrics for operating expenses and average revenue per user.

Wynn Resorts — The hotel and casino operator rallied 5.2% after reporting $1 billion in revenue for the fourth quarter, topping analysts’ expectations of $958 million, according to Refinitiv. The results prompted Jefferies to write in a note, “Vegas Is Starting to Sizzle.”

MGM Resorts International — The casino operator gained 6.2% after beating Wall Street’s expectations on fourth-quarter revenue, reporting $3.59 billion compared to estimates of $3.35 billion, according to Refinitiv. However, the company posted a wider-than-expected loss of $1.53 per share, versus the $1.36 loss per share predicted by analysts. Deutsche Bank on Thursday reiterated its buy rating on the stock, citing strong Las Vegas gaming.

● 장전 상황

Stocks rose Thursday as investors digested corporate earnings that came in better than previously feared.

Investors have been watching earnings season closely for insight on how companies have fared amid high inflation and how how they expect to perform going forward. But despite the latest batch of company reports, Wall Street has considered this earnings season lackluster.

Futures tied to the Dow Jones Industrial Average rose 205 points, or 0.6%. S&P 500 futures added 0.8%, and Nasdaq-100 futures gained 1.4%.

Disney shares gained more than 6% after the company posted smaller-than-expected subscriber losses along with earnings and revenue that beat estimates. PepsiCo advanced nearly 2% on the back of fourth-quarter earnings that came in above Wall Street expectations.

● Disney dominion

It’s Bob Iger’s Magic Kingdom, and we’re just living in it. Disney’s new/old CEO didn’t take long to put his stamp back on the company after he returned late last year following a relatively brief absence. During the company’s earnings call Wednesday, Iger unveiled a new corporate structure that makes ESPN its own unit, $5.5 billion in planned cost cuts and 7,000 layoffs. Disney had already been a top performer in the Dow since Iger’s return in November, and the announcement was just what Wall Street was looking for, as shares rose in off-hours trading. Even Nelson Peltz’s Trian, the activist firm embroiled in a proxy fight with Disney’s board, was impressed. “We are pleased that Disney is listening,” Trian told CNBC.

● Bard’s bad day

Investors didn’t appear to like Google’s event Wednesday to show off its Bard artificial intelligence chatbot. Shares of parent company Alphabet slid 7% during the trading session. It’s the latest stumble for online search leader Google. Rival Microsoft has outmaneuvered it with its support for OpenAI’s ChatGPT, which has seized the buzz in the early going of the AI wars. This week, as well, Microsoft announced that it would use ChatGPT to augment its Bing search engine and Edge internet browser. Still, while analysts got the impression that Google was rushing in a bid to seize some of the heat from Microsoft, they also think the company’s AI offering may well be as good as their competitors.

● The US said China’s spy balloon is part of a global surveillance scheme.

The devices are allegedly used to collect information about various countries’ military capabilities.

● MAERSK X MSC SHIP IS OVER

The world’s two largest shipping lines, Maersk and Mediterranean Shipping Co., are breaking up.

They claim it’s mutual, something about different needs (Maersk has big dreams of becoming a one-stop shop for logistics, while MSC wants to aggressively expand its own fleet). But the split also represents different bets on the shape of global trade in the decades to come—and on the forces of economic decoupling that will reroute the international flows of goods.

There are a few forces that are shifting the tides:

- Reshoring. Countries are increasingly bringing factories back home.

- Friendshoring. Countries with like-minded values are collaborating on protecting their own supply chains.

- New flows of trade. Historical manufacturing hubs are shifting away from China to countries like Vietnam and Mexico.