● 기업단신

Colgate-Palmolive — The maker of household and personal care products saw shares add more than 1% premarket after Morgan Stanley analysts upgraded the stock to overweight from equal weight. The Wall Street investment firm said the recent dropdown in shares create an attractive entry point for investors.

Boot Barn — The retailer was downgraded to neutral from outperform by Baird, which cited concerns over macroeconomic risks for the sector. Boot Barn shed 2.5% during premarket trading.

Retail stocks — Shares of Macy’s rose 0.35% in early trading after Goldman Sachs said it is best-positioned in retail with solid upside. Kohl’s dipped 2.4% after the firm rated it a sell, and Nordstrom shares ticked lower after Goldman downgraded it to neutral.

Tesla — The electric-vehicle maker was upgraded by Berenberg, which said Tesla’s price cuts are part of a broader strategy and that battery cell production is another opportunity for the company to scale. Tesla was down less than 1% in the premarket.

Salesforce — Morgan Stanley boosted its price target on the software stock to $236 from $228 per share, implying 43% upside from Friday’s close. The stock, however, was down more than 1% in premarket trading.

Intel — The chipmaker shed 1.5% in the premarket, after its fourth-quarter financial results missed Wall Street’s expectations Friday. Intel, which lost 9% on Friday, also forecast a loss for the current quarter.

Coinbase — JMP Securities reiterated its outperform rating on the stock, which has rallied 85% since the start of trading Jan. 9, analysts said in a note Friday. Coinbase, however, was down 2.7% in the premarket.

● 이번 주 실적발표

● 장전 상황

Stock futures traded lower on Monday morning amid a January rally as investors braced for the busiest week of earnings season and a possible interest rate hike from the Federal Reserve.

Futures tied to the Dow Jones Industrial Average slipped 128 points, or about 0.4%. S&P 500 futures fell 0.7%, and Nasdaq 100 futures dropped by 1.1%.

Wall Street is coming off a winning week as the stock market’s January rally continued. The Nasdaq Composite gained 4.3% for the week, while the S&P 500 and Dow added 2.5% and 1.8%, respectively. The S&P 500 is up 6% for 2023 following a 19% loss last year and closed at a new year-to-date high on Friday.

There are several tests this week for this 2023 rally. About 20% of the S&P 500 will report earnings this week, including McDonald’s and General Motors on Tuesday followed by tech giants Apple, Meta Platforms, Amazon and Alphabet later in the week.

- Tuesday:General Motors, McDonald’s, UPS, Pfizer, Spotify (before the bell); Snap, AMD (after the bell)

- Wednesday:Peloton (before the bell); Meta (after the bell)

- Thursday:Apple, Alphabet, Amazon, Ford, Starbucks, Qualcomm (after the bell)

● A top Chinese nuclear weapons lab has been acquiring blacklisted US chips. A 1997 US export ban hasn’t stopped the firm from buying semiconductors made by Intel and Nvidia since 2020, according to The Wall Street Journal.

* 필자의 생각: NVDIA 쪽 말도 일리가 있기는함. 이미 합법적으로 판매된 제품이 돌고돌아 최종 사용자가 누가 될 것이냐를 예상할 수 없다는 건데…차라리 중국군부 사용의심되는 제품군에는 앞으로 Backdoor를 만들어 놓는 건 어떨까? 쓰면 쓸 수록 기밀이 솔솔 빠지게…ㅋ

● Oil and gas producers in Texas are battening down against winter storms. The National Weather Service has predicted ice and cold rain, which can freeze gas supply lines and disrupt power grids

● Toyota was the world’s top car manufacturer in 2022. The company retained the title for a third consecutive year, selling 10.5 million vehicles—including a record 8.6 million overseas.

● Renault aims to cut Nissan stake

Two automotive titans are attempting to shake things up as the industry moves more aggressively into electric vehicles. France’s Renault and Japan’s Nissan said Monday they will restructure their agreement, which they struck in 1999. Under the deal, which requires approvals from their respective boards of directors, Renault would cut its holdings in Nissan to 15% from 43%, distributing a large chunk to a French trust that would have “neutralized” voting rights. Nissan also agreed to invest in Ampere, which is Renault’s electric vehicle business. The two will also work on “high-value-creation operational projects” in Latin America, India and Europe, they said.

● The latest from Ukraine

Ukraine President Volodymyr Zelenskyy pressed Western nations for quicker arms supplies as his country continues to face onslaughts from Russian missiles and fierce fighting on the battlefield. The U.S. and Germany have pledged to send dozens of tanks to Ukraine, leading to speculation that fighter jets would be next. However, German Chancellor Olaf Scholz said his nation opposed sending the aircraft to Ukraine. “The question of combat aircraft does not arise at all,” Scholz said to a German newspaper, according to a translation. Read live war updates here.

* 필자의 생각: Redline in order: HIMARS –> Tanks –> Figther Jets ㅋㅋ

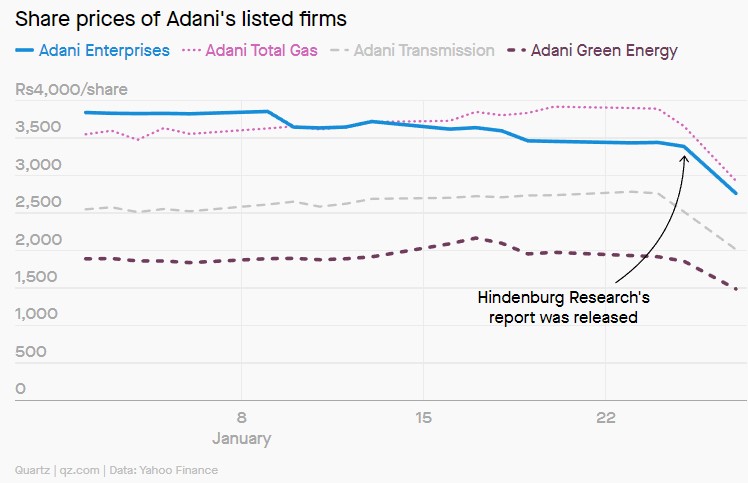

● WHY ARE ADANI STOCKS TUMBLING?

One of the richest people in the world, the Indian billionaire Gautam Adani, is in trouble.

Last week, Hindenburg Research, a New York-based financial research firm, published a report accusing the Adani Group of committing the “the largest con in corporate history.” Since then, the shares of some of the group’s companies have plunged over 40%, wiping out an estimated $71 billion in stock market value. On Monday morning (Jan. 30), the group’s flagship Adani Enterprises recovered somewhat, although it was still 15% down from its pre-Hindenburg mark.

The reverberations of this rout have been felt across Indian markets. Several public sector banks and the state-owned Life Insurance Corporation (LIC) hold large stakes in the company. If Adani collapses, taxpayers will also take a hit.

Hindenburg is no newcomer to taking aim at big corporate names. Founded in 2017 by activist short-seller Nathan Anderson, the firm has previously gone after the hedge fund Platinum Partners, the electric truckmaker Nikola, and Twitter.

* 필자의 생각: 아다니는 둘째치고 이제 힌덴버그 구독하고 싶다는…!!!