● ADP Employment Report

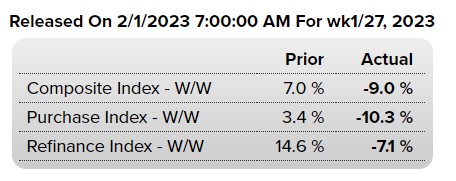

● MBA Mortgage Applications

● 기업단신

Peloton — The fitness equipment maker jumped more than 5% in the premarket after reporting fiscal second quarter revenue of $792.7 million, above a Refinitiv forecast of $710 million. Peloton said its net loss narrowed year over year and subscription revenue was higher than sales of the product.

Snap — The social media giant saw its shares slide more than 15% following its quarterly financial update. Snap missed analyst estimates for revenue and declined for a third straight quarter to provide guidance. Its “internal forecast” assumes a sales decline of between 2% and 10% from a year earlier.

Advanced Micro Devices — Shares of chipmaker AMD rose more than 3% premarket after the company reported fourth-quarter earnings and revenue that beat Wall Street expectations.

Electronic Arts — Shares of the video game publisher fell nearly 10% after the Electronic Arts’ fiscal third quarter results missed expectations for adjusted earnings and net bookings, according to StreetAccount. Fourth-quarter guidance also disappointed, as the company announced a delay of its upcoming Star Wars game to later this calendar year.

Foot Locker — The retailer added 3% following an upgrade to outperform from neutral by Credit Suisse. The firm said Foot Locker should see more profit going forward due to its strategic plan.

Match Group — The online dating company slid 8.3% after reporting quarterly revenue that missed Wall Street expectations. Match also said first-quarter revenue will likely be lower than expected.

Western Digital — Western Digital dropped nearly 3% after reporting an earnings miss after the bell Tuesday, although it beat on revenue. The company also said it anticipates revenue in the upcoming quarter to be lower than previously guided.

Brinker International — The casual dining chain reported adjusted earnings of 76 per share, compared to StreetAccount’s estimate of 52 cents for the fiscal second quarter. Revenue was $10.2 billion versus the $991.7 million expected by analysts. Brinker International was up 1.3% in the premarket.

● 장전상황

Dow opens more than 100 points lower as traders await Federal Reserve’s rate hike decision.

Stock futures slipped Wednesday as investors awaited the latest policy decision from the Federal Reserve.

Futures tied to the Dow Jones Industrial Average shed 188 points, or about 0.6%. S&P 500 futures were down nearly 0.4%. Meanwhile, Nasdaq-100 futures were 0.2% lower.

The Fed at 2 p.m. ET will announce how much it is increasing interest rates in its latest effort to tame high inflation, with market participants expecting its rate range at 4.50% to 4.75%, which is close to the Fed’s estimated end point of 5% to 5.25%. The Fed’s announcement will be followed by comments from Chair Jerome Powell.

● New month will test stock rally

Last month will be a tough act to follow. The S&P 500 posted its best January since 2019, while the Nasdaq recorded its best January in 22 years. All three major indices finished higher Tuesday, putting an exclamation point on the month as bulls look to build momentum after last year’s declines. And while investors will be chewing over what the Fed has to say Wednesday, they’ll have lots more on their minds as earnings season presses forward. Facebook parent Meta reports after the bell Wednesday, and Thursday will be an earnings bonanza, with Apple, Amazon, Starbucks and others due to report. Read live markets updates.

● FBI searching Biden home in Rehoboth, Delaware

FBI agents are searching the Rehoboth, Delaware, beach home of President Joe Biden, sources told NBC News on Wednesday.

The agents arrived Wednesday morning at Biden’s home there, according to the sources.

● Google under AI pressure

It’s “code red” at Google as the search giant races to compete with the buzzy artificially intelligent chatbot ChatGPT. Google’s “Atlas” project is testing a chatbot called “Apprentice Bard,” which is intended to give complex answers to questions much the way ChatGPT does. Employees are also testing whether it could be integrated into a search engine. The news, reported by CNBC’s Jennifer Elias, comes after employees pressured executives in December over how parent company Alphabet was going to respond to ChatGPT’s sudden burst of popularity. At the time, CEO Sundar Pichai and Google AI chief Jeff Dean hinted that the company could release similar products during 2023.

*필자의 생각: 이미 계획되어 있었더라도 올해 발표되는 Google AI 성능이 최소 ChatGPT와 유사하거나 그 이상이 되어야지 아니라면 기술부심에 흠집 날텐데…

● Boeing delivered its last-ever 747 plane. A ceremony to honor the “queen of the skies” marked the end of an era that saw big changes to aviation.

● Dangerous radioactive capsule found

We’ve been hearing a lot about the tiny – we’re talking 6 mm by 8 mm here – radioactive capsule that fell off a truck deep in a remote part of Australia. Thankfully, authorities said it was found after an extensive, nearly weeklong search about 1,100 kilometers north of Perth. The object, which is part of a measurement gauge, could have caused severe radiation burns and sickness for anyone who came in contact with it. Indeed, authorities told people to stay about three yards away from the device if they spotted it. (Then again, how could you spot such a tiny thing from that distance?) Mining company Rio Tinto apologized earlier this week for the mishap.

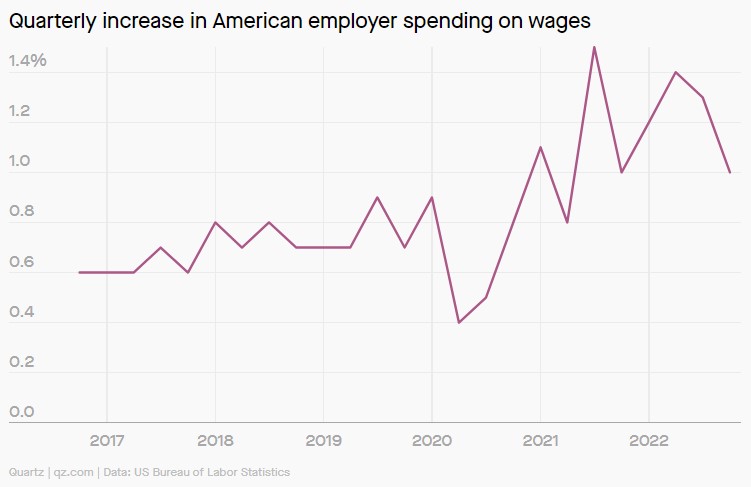

● GOOD LUCK GETTING THAT RAISE

Something is happening with American wages that’ll likely satisfy the Federal Reserve much more than the average worker: Employers aren’t spending as much on employee pay.

In fact, wage growth is falling back to around where it was before the pandemic started. The Fed will be happy with this because it shows that employer costs are falling, giving them fewer reasons to raise prices. But while inflation could cool because of this, workers now have less leverage to negotiate higher wages for themselves.

It’s not just pay that’s getting a tighter budget. Companies are slashing benefits and free lunches in an attempt to rein in spending—another sign that in the battle between workers and employers, workers are losing.

● A bunch of gemstones were found at a swimming pool.

Ancient Romans dropped them down the drain some 2,000 years ago.