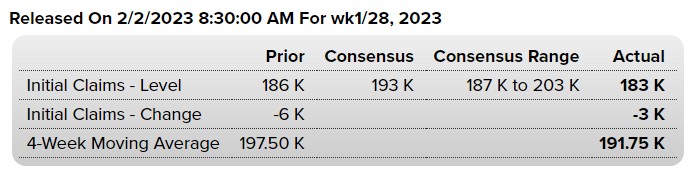

● Jobless Claims

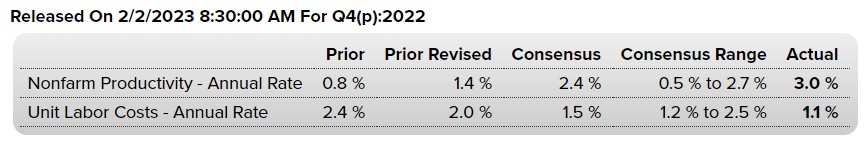

● Productivity and Costs

● 기업단신

Meta — Shares of the Facebook parent surged 19% in early morning trading after the company posted better-than-expected revenue and announced a $40 billion stock buyback when it reported its quarterly results Wednesday evening. Bank of America upgraded Meta Thursday, saying the company’s new efficiency mentality positions stock for more than 40% upside. The spike in shares helped pull other mega cap tech companies Amazon and Alphabet up by 4% each.

Align Technology — The orthodontics company saw its shares rise 14% after its quarterly earnings and revenue beat analyst expectations. Align also said it will repurchase up to $1 billion of its common stock over the next three years.

FedEx — The shipping giant rose more than 3% after both Citi and Bank of America upgraded the stock. Citi said it sees “increasing signs of cost control following its missteps in 2022.” On Wednesday, the company announced it will lay off 10% of its officers and directors amid cooling demand.

Merck — Shares of the pharmaceutical giant dipped more than 1% despite Merck beating estimates on the top and bottom lines for the previous quarter. The company reported $1.62 in adjusted earnings per share on $13.83 billion in revenue. Analysts surveyed by Refinitiv had penciled in $1.54 per share on $13.67 billion of revenue. Merck did project sales and adjusted earnings to decline in 2023.

Honeywell — Shares of the industrial company fell more than 5% in premarket trading after Honeywell’s revenue for the fourth quarter came in short of expectations. The company generated $9.19 billion of revenue, while analysts surveyed by Refinitiv were looking for $9.25 billion. The safety and productivity solutions segment saw sales decline 5% year over year. Honeywell’s adjusted earnings per share came in at $2.52, 1 cent above estimates.

Tesla — The EV maker saw a 1.8% boost in its shares following a Reuters report that the company will raise output at its Shanghai factory to almost 20,000 vehicles per week for February and March. This would be in response to higher demand after the company cut prices.

e.l.f. Beauty — Shares for the cosmetics company jumped 1.67% after its fiscal third quarter revenue topped analysts’ estimates. The company announced adjusted earnings of 48 cents per share on revenue of $146.5 million. Refinitiv analysts had previously called for per-share earnings of 23 cents on revenue of $121.8 million. The beauty brand also raised its full-year outlook.

C.H. Robinson — The freight company dipped 1.7% after its earnings and revenue fell short of expectations, according to analysts polled by Refinitiv. C.H. Robinson earned $1.03 per share on revenue of $5.07 billion. Analysts expected earnings of $1.38 per share on revenue of $5.68 billion.

Qorvo — The semiconductor company tumbled approximately 3% following its disappointing earnings report. Qorvo reported a fiscal third quarter loss of $15.9 million and earnings of 16 cents per share. Analysts polled by StreetAccount had anticipated per-share earnings of 62 cents on revenue of $725.9 million.

Corteva — Shares of the agricultural chemical company dipped 1.8% following a mixed earnings report. Corteva topped operating earnings expectations for the most recent quarter, according to StreetAccount, but fell short of revenue estimates. Guidance for operating earnings and revenue was weaker than expected.

● 장전 상황

The Federal Reserve raised its benchmark rate by a quarter of a point Wednesday, as expected, but investors jumped on what they saw as slightly more dovish language from Chairman Jerome Powell. While he said it would be “premature” for the Fed to claim a victory over inflation, Powell said the “disinflationary process has started.” He also said the economy could be in for a soft landing, after all: “My base case is that there will be positive growth this year.”

Stock futures gained on Thursday as better-than-expected Meta results further improved sentiment around technology shares, which led the market lower last year.

The gains come ahead of a trio of Big Tech results after the bell in Apple, Amazon and Alphabet.

S&P 500 futures jumped nearly 1%, while the tech-heavy Nasdaq-100 futures gained 2%. Meanwhile, futures connected to the Dow Jones Industrial Average added 41 points, or about 0.1%.

● Biden and McCarthy start talking

There’s no deal over the debt ceiling yet, but President Joe Biden, a Democrat, and House Speaker Kevin McCarthy, a Republican, got the ball rolling Wednesday. Both sides expressed cautious optimism over the talks as they try to prevent the United States’ first ever default on its debt, which could be catastrophic for the economy. “We have different perspectives. But we both laid out some of our vision of where we’d want to get to. And I believe, after laying them both out, I can see where we can find common ground,” McCarthy told reporters. The Treasury Department, meanwhile, has taken steps to avoid default at least until early June.

* 어차피 결국에는 합의할 꺼면서…그놈의 ‘사상초유의 미국 정부 디폴트를 막기위해’ 어쩌구…결국 연방공무원만 신나는 기간이 돌아옴…

● The US boosted its defense and diplomatic efforts in the Asia Pacific. The Philippines agreed to an increased American military presence on its soil, while the US embassy in the Solomon Islands reopened after 30 years.

● Shell’s blowout year

Oil behemoth Shell on Thursday reported its biggest annual profit ever: $39.9 billion in 2022. That’s more than double its earnings for 2021, and it’s well ahead of its previous record of $28.4 billion in 2008. Sky-high energy prices, driven by supply concerns stemming from Russia’s war in Ukraine, boosted the results. Shell is following similarly huge earnings reports from rivals ExxonMobil and Chevron. All told, Big Oil is expected to break annual profit records in total. That isn’t sitting well with climate activists. “What we saw happening in 2022 is that the oil majors used the high oil prices and the energy crisis to convince investors that the energy crisis should eclipse the climate crisis — and that has caused a setback,” Mark van Baal, founder of Dutch activist shareholder group Follow This, previously told CNBC.

● Meta’s music to Wall Street’s ears

We’re far beyond “Move fast and break things.” It’s all about the “Year of Efficiency” at Mark Zuckerberg’s Meta. After a rough 2022, the Facebook parent told Wall Street exactly what it wanted to hear as it reported earnings after the bell Wednesday. Zuckerberg said the company is “focused on becoming a stronger and more nimble organization.” Meta also cut its estimated total expenses for 2023, while pledging to trim nonperforming or ultimately unimportant projects. The stock ripped about 20% higher in off-hours trading. Still, there are some lingering reasons for doubt, notably the company’s continued dedication to its so-far-underwhelming metaverse business. Meta’s Reality Labs lost $13.7 billion last year, and there are no plans to cut back as of now.

● Getting worse for Adani

One small U.S.-based short-seller has managed to create epic problems for India’s Adani Group, a sprawling conglomerate whose businesses include energy generation, ports and food processing, among several others. Since Hindenburg Research, the short seller in question, published a report last week accusing of Adani of “brazen stock manipulation and accounting fraud scheme over the course of decades,” the company has lost $100 billion in value. Adani, which is led by politically connected tycoon Gautam Adani, has called the accusations “nothing but a lie.” Because of the chaos, however, Adani called off a $2.5 billion share offering, even though it had been fully subscribed.