● Employment Situation

● 기업단신

Alphabet — Shares declined more than 3% after Google-parent Alphabet missed analyst expectations in its latest earnings report. Alphabet earned $1.05 per share, lower than the expected earnings of $1.18 per share, according to consensus estimates from Refinitiv. It posted revenue of $76.05 billion, less than the forecasted $76.53 billion.

Apple — The tech giant saw its stock fall about 2% in premarket after the company missed expectations for revenue, profit, and sales for many of its lines of business. Apple’s overall sales for the holiday quarter fell 5% year over year, marking the company’s first top-line decline since 2019.

Amazon — Amazon dropped 4% after the e-commerce giant reported its fourth-quarter results. Although the company’s quarterly sales beat analysts’ estimates, current-quarter guidance came in somewhat light of expectations. The e-retailer estimates its first-quarter revenue to fall between $121 billion and $126 billion. Meanwhile, analysts were expecting sales to come in at $125.1 billion, according to Refinitiv.

Ford – Shares of Ford slipped 6.5% after the company reported earnings that badly missed Wall Street’s earnings expectations. The automaker reported adjusted earnings per share of 51 cents on $41.8 billion in revenue where analysts polled by Refinitiv expected adjusted earnings per share of 62 cents and $40.37 billion in revenue. The company also posted a net income that was down more than $1 billion on the year.

Starbucks — The coffee giant’s shares slid 2.10% after the company’s earnings report fell short of expectations. Starbucks reported earnings per share of 75 cents compared to Refinitiv analysts’ projections of 77 cents. Revenue also fell short of the $8.78 billion Refinitiv estimates, coming in at only $8.71 billion. Weakened international demand, particularly in its second-largest market China, weighed on the results.

Qualcomm — The semiconductor group saw its stock drop almost 3% after its top line fell short during its fiscal first quarter. Qualcomm’s revenue fell 12% year over year during the quarter. The company cited macroeconomic conditions and higher channel inventory as headwinds to its results. The company’s stock has fallen 24% in the past year.

Nordstrom — Shares of Nordstrom rallied 27% after The Wall Street Journal reported that activist investor Ryan Cohen is building a sizeable stake in the retailer. The report, which cites people familiar with the matter, also said Cohen will push for changes to Nordstrom’s board following a sharp stock price drop.

Clorox — The cleaning products producer saw its shares rise 3.55% before the bell on the back of strong quarterly numbers. Clorox posted fiscal second quarter earnings of 98 cents per share, excluding items, on revenue of $1.72 billion. That compares to earnings of 65 cents per share on revenue of $1.66 billion estimated by analysts, according to Refinitiv.

● 장전상황

As of Thursday’s close, the Nasdaq Composite gained nearly 5%, riding a tech-fueled rally to outperform the other major indexes. It’s on pace for its fifth-straight winning week. Meanwhile, the S&P 500 is up about 2.7%. The Dow, however, is just slightly higher this week, up 0.2%.

Stocks slid Friday as traders digested strong U.S. labor data, as well as several high-profile earnings misses.

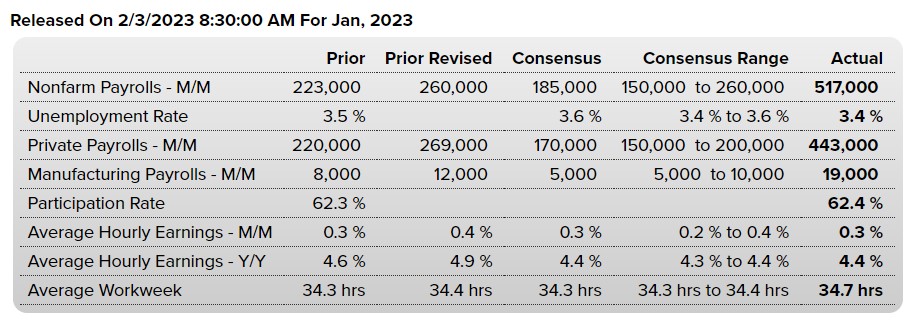

The January jobs report came in much better than expected. Employers added 517,000 jobs last month, well above the slowdown economists were expecting – 187,000 jobs added vs. 223,000 in December. The unemployment rate also came in at 3.4%, lower than estimates of 3.6%.

Dow Jones Industrial Average dropped 109 points, or about 0.4%. The S&P 500 lost 1.1%, while the Nasdaq Composite fell 1.8%.

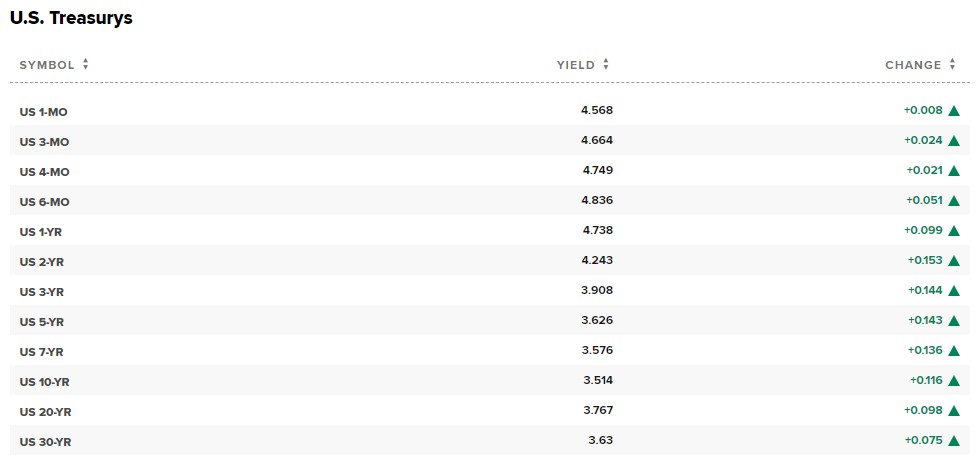

Treasury yields leaped after the report hit the wires. Stock futures dipped, but they were already in the red Friday morning after Thursday’s spate of rough tech earnings.

● China Covid surge saps Starbucks sales

Coronavirus cases surged in China after the government relaxed its zero Covid policy, which in turn led to more pressure on businesses. Starbucks on Thursday said transactions at cafes in China, its second largest market, fell by nearly 30% year-over-year in the most recent quarter. The company still stuck with its full-year guidance, despite the downbeat results from China. And Starbucks also expects things to turn around in the country during the second half of its fiscal year after negative same-store sales growth persists through the fiscal second quarter.

● Suspected Chinese spy balloon spotted

American officials said Thursday they were monitoring what they suspected to be a Chinese spy balloon floating over the northern part of the United States. China has sent spy balloons over the U.S. before, but not usually for this long, officials told NBC News. The revelation about the balloon came days before Secretary of State Antony Blinken was set to meet with Chinese President Xi Jinping. China, meanwhile, called for calm as it looked into the situation. U.S. defense officials said the device’s intelligence-gathering ability was limited, and so far they have opted against shooting it down out of concerns that debris could hurt people and damage property on the ground.

* 기술력의 차이라고나 할까? 스파이 위성 vs 스파이 풍선…ㅉ

이 상황에서 중국정부나 재미중국대사관에서 긍정도 부정도 안한다면 그건 긍정이겠지? ㅋㅋ

그나저나 이거 미국 영공이면 그냥 터뜨려버려도 되는거 아냐?

●AUSTRALIA’S $5 BILL BIDS ADIEU TO THE MONARCHY

If King Charles III had a 2023 bingo card with a square reading “become the next face of Australia’s $5 bill,” he’s fresh out of luck.

The Land Down Under decided the replacement for the late Queen Elizabeth II won’t be anyone from the British monarchy, even though it’s technically Australia’s head of state. Instead, the new banknote will honor Aboriginal peoples who have inhabited the territory for over 50,000 years. Hopefully it won’t take that many years for the new design to enter circulation.